How to Invest in Crypto Devoid of Obtaining Coins

The easiest way to acquire financial investment exposure to crypto devoid of obtaining crypto alone is to buy stock in a company by using a fiscal stake in the way forward for cryptocurrency or blockchain technologies.

But buying person shares can bear related challenges as purchasing cryptocurrency. In lieu of deciding on and buying particular person stocks, specialists endorse investors set their cash in diversified index cash or ETFs as a substitute, with their confirmed history of long-time period development in worth.

“Truth be told, most persons which has a retirement approach or an investment decision portfolio allocated in an index fund have already got some publicity to crypto,” states Daniel Johnson, a CFP with ReFocus Monetary Preparing.

Lots of the finest index funds — like S&P 500 or complete current market cash — include publicly traded providers that have some involvement Along with the market by both mining crypto, being involved with the event of blockchain technologies, or Keeping substantial quantities of crypto on their stability sheets, claims Johnson.

Such as, Tesla — which holds about a billion dollars in Bitcoin and approved Bitcoin payments in past times — is A part of any money that monitor the S&P 500. Given that its 2020 inclusion, it’s turn into One of the more precious, and as a consequence influential firms within the index. And Coinbase, the sole publicly traded cryptocurrency exchange, is inside the ARK Fintech Innovation ETF.

Nevertheless, When you've got some added income (and also you’re tolerant of the danger), you are able to decide to allocate a small quantity of your portfolio to certain companies or even more specialized index funds or mutual resources. “An Trader bullish on the future of cryptocurrency could spend money on the stocks of companies working on that technologies,” states Jeremy Schneider, the personal finance skilled guiding Personal Finance Club.

Professionals generally endorse retaining these speculative investments — irrespective of whether only one organization’s inventory, specialized index money, or cryptocurrency itself — to lower than five% of the total investing portfolio.

Investing in Firms with Crypto Passions

That’s how personal finance qualified Suze Orman originally did it. She a short while ago explained to NextAdvisor regarding how she invested in MicroStrategy, a cloud computing company that retains billions in Bitcoin, since its CEO was putting all of the corporate’s working money into Bitcoin. She figured if Bitcoin enhanced in price, so would the value of Microstrategy’s inventory.

But as anyone who follows Orman’s guidance appreciates, she recommends index cash being a much better financial investment method than choosing particular person shares.

As an alternative to buying shares in any one crypto-ahead organization, it’s improved to keep up a well balanced portfolio by figuring out companies with crypto interests, and ensuring that their shares are included in any index or mutual money you put money into. Don't just does that let you put money into the businesses in which you see opportunity, but it also will help you keep your investments diversified in just a broader fund.

In the event you make investments with Vanguard, for example, You can utilize the positioning’s Keeping lookup to search out many of the Vanguard cash that include a certain company. Just enter the corporation’s ticker symbol (like TSLA for Tesla) as well as the Software will provide an index of all of the Vanguard products that have holdings of its shares. Other investing platforms provide identical means to look by enterprise inside index and mutual funds.

But specialized ETFs or mutual money may come with larger service fees than whole marketplace indexes, so concentrate to exactly how much you’re destined to be billed for getting shares. Schneider considers an expenditure ratio (Everything you shell out in expenses) under 0.2% to get very reduced, and anything around one% to generally be quite expensive. For an currently speculative investment, superior costs can hinder your development even more.

Here are some far more samples of publicly-traded companies which are including Bitcoin or blockchain technologies to their business enterprise. These are definitely absolutely not the only organizations concerned, plus much more are becoming a member of the list daily. (Circle, a electronic payment System specializing in crypto payments, for example, just declared its intended IPO):

MicroStrategy (MSTR)

MicroStrategy offers company intelligence Puppy token and cloud companies, and invests its assets into Bitcoin.

Marathon Electronic Holdings (MARA)

Marathon Electronic Holdings aims to become the largest bitcoin mining Procedure in North The united states.

RIOT Blockchain (RIOT)

Riot Blockchain can be a Bitcoin mining company.

Bitfarms (BITF)

Bitfarms operates blockchain computing facilities.

Galaxy Electronic (BRPHF)

Galaxy Electronic is usually a broker-dealer associated with crypto financial investment management, trading, custody, and mining.

Tesla (TSLA)

Tesla’s founder Elon Musk, is really a proponent of cryptocurrency, and the corporate retains more than a billion dollars truly worth of Bitcoin. It temporarily approved Bitcoin payments in early 2021 right before ending This system, but Musk recently claimed Tesla will “almost certainly” restart Bitcoin payments.

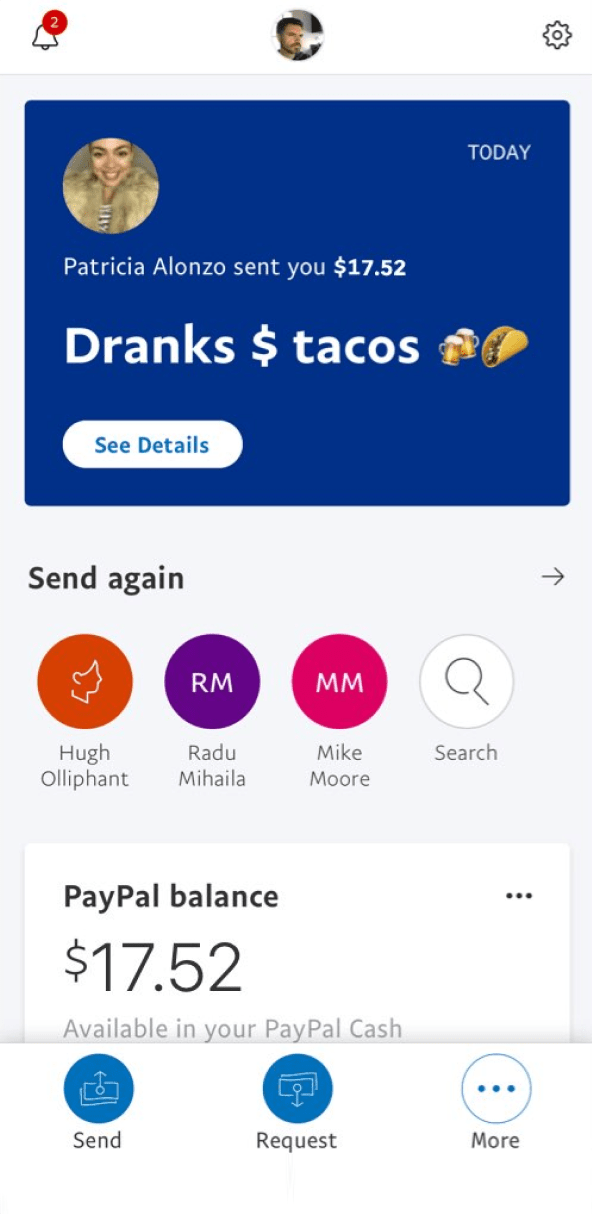

PayPal (PYPL)

PayPal can be a payment System wherever people today should purchase cryptocurrency.

Square (SQ)

Sq. not long ago declared that It will be moving into the decentralized finance space.

Coinbase (COIN)

Coinbase is the first community cryptocurrency Puppy Crypto exchange. It debuted within the Nasdaq in spring 2021.

Blockchain ETFs

ETFs — Trade traded money — operate just like a hybrid between mutual resources and shares. An ETF is essentially a group of stocks, bonds or other assets. Whenever you purchase a share of http://www.thefreedictionary.com/Puppy Crypto an ETF, there is a stake while in the basket of investments owned through the fund.

Whilst several ETFs — which include complete market ETFs — have quite lower price ratios, specialized ETFs could be nearer to your 1% ratio that Schneider would think about quite high priced. This will make much less of an impression if more expensive ETFs comprise a small part of your overall portfolio, Consider the expense When it comes to choices.

ETFs are frequently grouped by what sort of investments they keep, so A technique you are able to indirectly spend money on cryptocurrency is by Placing money into an ETF focused on its underlying technological innovation: blockchain. A blockchain ETF will involve firms possibly employing or building blockchain know-how.

Numerous people who are skeptical about cryptocurrency but believe in the “transformative” blockchain engineering driving it see blockchain ETFs as a much more seem expenditure.

It’s such as California gold rush of your 1800s, suggests Chris Chen, CFP, of Perception Fiscal Strategists in Newton, Massachusetts, to get a the latest NextAdvisor story about blockchain technologies: “Lots of folks rushed in there to dig for gold, and A lot of them in no way produced any funds,” he mentioned. “The folks who made The cash are people who sold the shovels. The companies that happen to be supporting the development of blockchain will be the shovel sellers.”

ETFs are developed by unique organizations, however, you can normally obtain them as a result of whichever brokerage you usually use to take a position. Much like you could lookup your brokerage for specific shares, You may also try to find funds utilizing the symbols connected with them. Here are some blockchain ETFs now available to buyers (with listings on well known brokerages like Fidelity, Vanguard, and Charles Schwab):

BLOK (Amplify Transformational Knowledge Sharing ETF)

BLOK is the largest blockchain ETF by total property. It’s major holdings are PayPal, MicroStrategy, and Square.

BLCN (Siren Nasdaq NexGen Overall economy ETF)

BLCN’s leading holdings are Coinbase, Accenture, and Square.

LEGR (1st Have confidence in Indxx Revolutionary Transaction & Method ETF)

LEGR’s prime holdings are NVIDIA, Oracle, and Fujitsu.